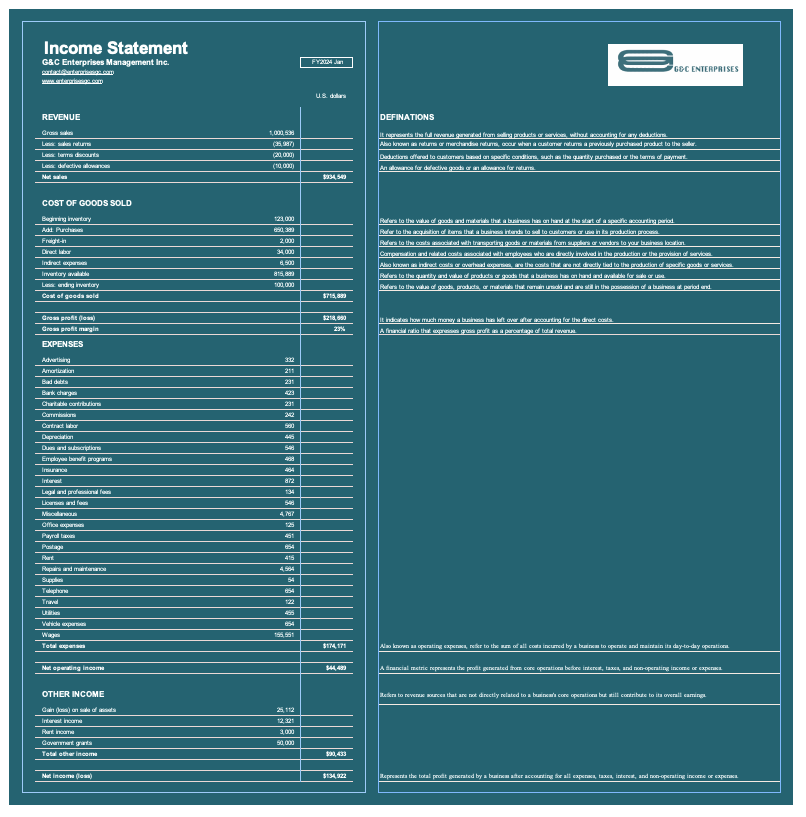

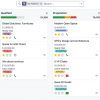

An income statement, also known as a profit and loss statement (P&L), is a financial report that provides a summary of a business’s revenues, expenses, and profitability over a specific period, usually a fiscal quarter or year. The income statement is a crucial financial statement that helps stakeholders, such as investors, creditors, and management, understand the financial performance of a business’s operations.

-

Structure

- Revenue or Sales: This section lists the total revenue generated from the sale of goods or services.

- Cost of Goods Sold (COGS): The direct costs associated with producing or purchasing the goods that were sold.

- Gross Profit: Calculated as Revenue minus COGS, gross profit represents the profit generated from core operations.

- Operating Expenses: These include all indirect costs necessary to operate the business, such as salaries, rent, utilities, marketing, and more.

- Other Income: This section includes non-operating income (e.g., interest income, gains from the sale of assets) and non-operating expenses (e.g., interest expenses).

- Net Income/Loss: Final profit or earnings generated by the business after accounting for all expenses, taxes, and non-operating items.

Reviews

There are no reviews yet.