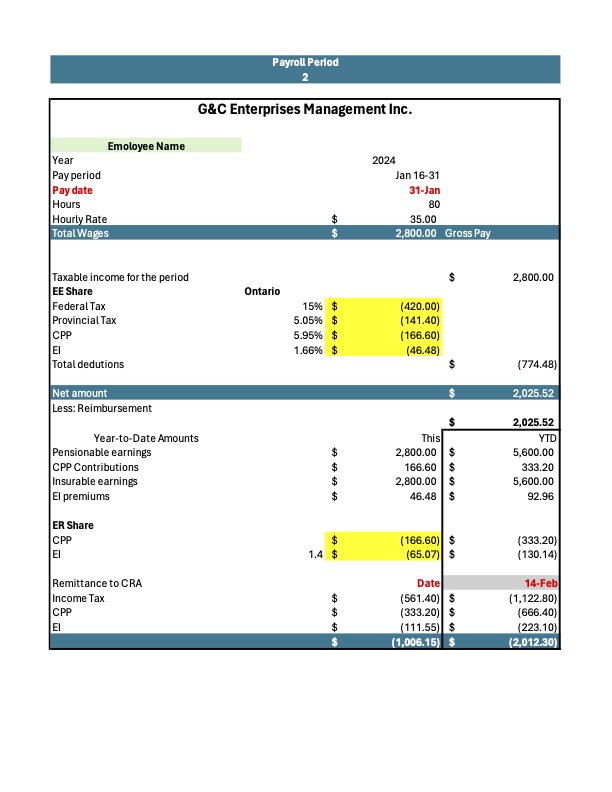

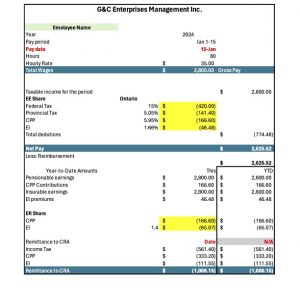

This Canada payroll worksheet involves considering several key elements such as gross pay calculations, deductions for federal and provincial taxes, Canada Pension Plan (CPP) contributions, Employment Insurance (EI) premiums, and any other applicable deductions.

Here’s a simplified structure you might use for a Canadian payroll worksheet:

- Employee Information.

- Gross Pay Calculations

- Deductions

- Net Pay

- Employer Contributions

- Year-to-Date Totals

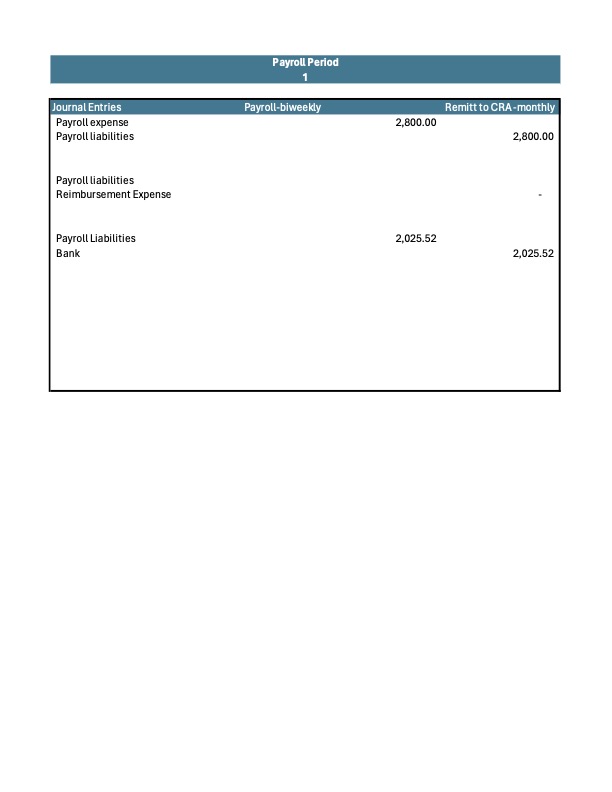

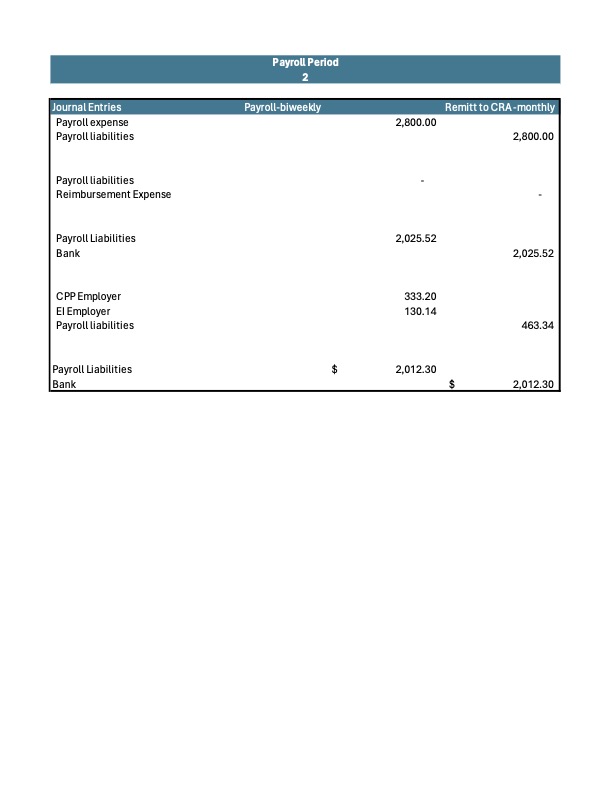

- Journal Entries

To accurately fill out this worksheet, you’ll need the latest tax tables and contribution rates for CPP and EI. You can find these details on the Canada Revenue Agency (CRA) website or use payroll software that automatically updates these rates.

1 review for Canada Payroll Worksheet Template